Rekt Capital – Cryptocurrency Technical Analysis Course

$ 149,00 Original price was: $ 149,00.$ 17,00Current price is: $ 17,00.

Cryptocurrency Technical Analysis Course By Rekt Capital: Master Crypto Trading With Expert Strategies

In the volatile world of cryptocurrency trading, technical analysis serves as your navigation system—providing clarity amid market chaos. Rekt Capital’s Cryptocurrency Technical Analysis Course stands as a premier education resource in this space, offering both novice and experienced traders a structured path to mastery. This comprehensive guide explores everything the course offers, from curriculum details to real-world applications, helping you make an informed decision about your trading education journey.

What Is the Cryptocurrency Technical Analysis Course By Rekt Capital?

The Cryptocurrency Technical Analysis Course By Rekt Capital is a comprehensive educational program specifically designed for cryptocurrency enthusiasts looking to master the art of technical analysis in crypto markets. This in-depth course delivers over 17 hours of expert video tutorials and interactive webinars, making it suitable for both beginners and intermediate traders seeking to enhance their crypto trading skills through advanced technical analysis techniques.

Developed by renowned crypto analyst Rekt Capital, this course stands out for its structured approach to teaching practical cryptocurrency trading strategies that work in real-world market conditions. Participants gain lifetime access to content that covers essential trading concepts from basic chart reading to advanced indicator analysis, all tailored specifically for the volatile cryptocurrency market.

Why Choose the Cryptocurrency Technical Analysis Course?

The Rekt Capital Technical Analysis Course offers several distinctive advantages:

- Comprehensive Learning Experience: The course provides an extensive exploration of technical analysis, covering a wide range of essential topics from basic chart patterns to advanced indicator combinations.

- Practical Application Focus: Learn to apply technical analysis tools in real-world trading scenarios with hands-on examples and case studies from actual market conditions.

- Expert Instruction: Benefit from the knowledge and experience of Rekt Capital, a recognized authority in cryptocurrency technical analysis.

- Dual Format Learning: Each concept is presented through both tutorial videos and follow-up webinars, reinforcing learning through different teaching approaches.

- Lifetime Access: Enjoy unlimited access to all course materials on both mobile and PC platforms, allowing for continuous learning and reference.

- Integrated Risk Management: Unlike many courses that focus solely on analysis, this program emphasizes proper risk management techniques essential for long-term trading success.

What You’ll Learn From the Cryptocurrency Technical Analysis Course By Rekt Capital

The Cryptocurrency Technical Analysis Course provides a comprehensive education in multiple critical areas of crypto technical analysis:

- Fundamental Technical Analysis: Master the essential tools and principles necessary for navigating the volatile cryptocurrency market, including detailed chart interpretation and market trend analysis.

- Advanced Charting Techniques: Develop proficiency in utilizing sophisticated charting tools to analyze cryptocurrency price movements in real-time, with in-depth training on candlestick, bar, and line charts.

- Trend Identification Strategies: Learn reliable methods to distinguish between temporary price fluctuations and sustainable long-term trends, helping you maximize profits while avoiding common trading pitfalls.

- Support and Resistance Analysis: Gain expertise in identifying crucial support and resistance levels to determine optimal entry and exit points, properly set stop-losses, and secure profits.

- Candlestick Pattern Recognition: Explore various candlestick patterns that signal potential market movements and reflect current market sentiment, essential knowledge for making strategic trading decisions.

- Technical Indicator Mastery: Receive detailed instruction on implementing key technical indicators such as Moving Averages, MACD (Moving Average Convergence Divergence), and RSI (Relative Strength Index) to identify trading opportunities.

- Risk Management Framework: Beyond trading techniques, learn comprehensive risk management strategies for cryptocurrency trading, including portfolio structuring, position sizing, and the psychological aspects of trading.

Course Structure and Content

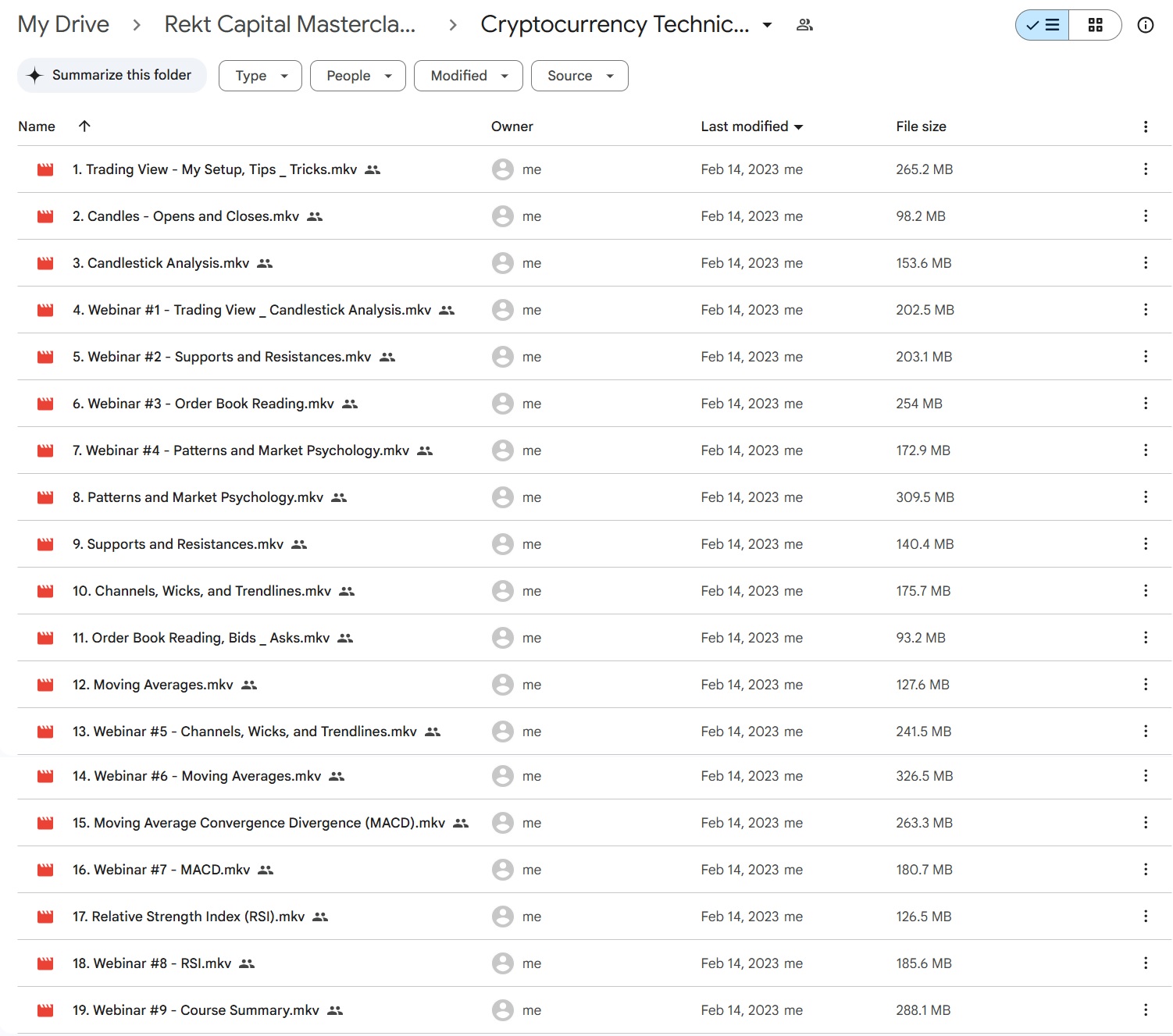

The Cryptocurrency Technical Analysis Course By Rekt Capital is meticulously structured into 18 comprehensive technical analysis modules and 10 specialized risk management tutorials:

Technical Analysis Modules:

- Trading View Pro Techniques (58 minutes)

- Candlestick Analysis Tutorial (64 minutes)

- Trading View & Candlestick Analysis Webinar (69 minutes)

- Supports and Resistances Tutorial (38 minutes)

- Support and Resistances Webinar (59 minutes)

- Order Book Reading Tutorial (30 minutes)

- Order Book Reading Webinar (63 minutes)

- Patterns & Market Psychology Tutorial (70 minutes)

- Patterns & Market Psychology Webinar (55 minutes)

- Channels, Wicks, and Trend-lines Tutorial (43 minutes)

- Channels, Wicks, and Trend-lines Webinar (70 minutes)

- Moving Averages Tutorial (35 minutes)

- Moving Averages Webinar (55 minutes)

- MACD (Moving Average Convergence/Divergence) Tutorial (62 minutes)

- MACD Webinar (61 minutes)

- RSI (Relative Strength Index) Tutorial (41 minutes)

- RSI Webinar (56 minutes)

- Course Summary: Comprehensive Application (65 minutes)

Risk Management Modules:

- Introduction to Risk Management

- Portfolio Structuring and Diversification

- The Psychology of Risk Management

- The Bitcoin vs Altcoin Correlation

- Planning Your Trade, Risk-to-Reward Ratio

- The Impact of Emotions on Probability

- The Stop Loss Implementation

- Trade Management and Risk Reduction Strategies

- Position Sizing Techniques

- Hedging Strategies for Crypto Markets

📗 FILE SIZE: 3.71 GB Ι PROOF OF COURSE:

Who Should Enroll in the Cryptocurrency Technical Analysis Course?

This technical analysis course is ideally suited for:

- Beginner Cryptocurrency Traders: Those new to crypto trading will benefit from the course’s foundational approach, which starts with fundamental concepts before progressing to more sophisticated analysis techniques.

- Intermediate Traders: Experienced traders looking to refine their skills will gain valuable insights into advanced technical indicators and strategies to improve trading outcomes.

- Crypto Investors: Long-term cryptocurrency investors seeking to make more informed entry and exit decisions based on technical market signals.

- Aspiring Technical Analysts: Individuals pursuing careers in cryptocurrency analysis or wanting to develop professional-grade technical analysis skills.

Who is Rekt Capital?

Rekt Capital is a highly respected cryptocurrency trader and technical analyst, renowned for translating complex market data into clear, actionable insights. Featured in publications such as Forbes, CoinTelegraph, and Real Vision, he offers cutting-edge research on Bitcoin, Altcoins, and broader crypto market trends. Through his engaging tutorials, social media presence, and newsletter, Rekt Capital empowers traders worldwide to make informed decisions in the ever-changing realm of digital assets.

Real-World Trading Applications and Student Success Stories

Case Study: Bitcoin Bull Market Technical Analysis Strategy

This section presents a comprehensive technical analysis approach to navigating Bitcoin bull markets, featuring:

- Historical analysis of past Bitcoin bull cycles through technical indicators

- Early identification of bull market phases using key technical patterns

- Strategic entry point identification during bull market corrections

- Position building and scaling strategies during uptrends

- Recognizing technical warning signs of cycle peaks

- Exit strategies based on technical exhaustion signals

The case study demonstrates how technical analysis provided objective guidance during the emotional extremes of bull markets, allowing for rational decision-making when market sentiment reached maximum optimism. Students learn how applying course principles would have optimized entries and exits during previous major Bitcoin bull runs.

By analyzing both successful applications and missed opportunities in previous cycles, students develop a framework for approaching future bull markets with greater strategic precision. This practical application bridges the gap between theoretical knowledge and real-world results.

Case Study: Navigating Bear Markets with Technical Analysis

This section explores how technical analysis provides critical guidance during challenging bear market conditions:

- Early identification of major market tops through technical patterns

- Defensive positioning strategies based on breakdown signals

- Identifying accumulation phases during prolonged downtrends

- Distinguishing between relief rallies and genuine trend reversals

- Strategic building of positions at technical bear market bottoms

The case study highlights how technical analysis helps traders avoid the common pitfalls of bear markets—including falling knives, bull traps, and premature position building. By studying previous crypto bear markets through a technical lens, students develop objective criteria for navigating these challenging phases.

Emphasis is placed on the psychological benefits of technical analysis during bearish periods, providing clarity when market sentiment reaches maximum pessimism. Students learn how course principles apply specifically to capital preservation and strategic accumulation during extended downtrends.

Student Success Transformations and Trading Journeys

This section shares actual results and transformations from course graduates:

- Before-and-after trading approach changes from course implementation

- Specific technical setups that led to profitable trades for students

- Diverse application across different trading styles (swing trading, position trading, etc.)

- Common challenges overcome through course methodologies

- Quantifiable improvements in trading performance metrics

These success stories are presented with realistic context—acknowledging the learning curve and adaptation period required while showcasing the potential outcomes of consistent application. The focus remains on how the technical analysis framework improved decision-making quality rather than making unrealistic profit claims.

By highlighting diverse student experiences, this section demonstrates how the course principles adapt to different trading styles, market conditions, and individual goals—reinforcing that technical analysis is a versatile framework rather than a rigid system.

Practical Implementation: From Course Completion to Profitable Trading

Post-Course Action Plan for Immediate Implementation

This section provides a structured roadmap for applying course concepts immediately after completion:

- First 30-day implementation plan with specific learning objectives

- Progressive skill-building exercises for pattern recognition development

- Simulated trading exercises to build confidence before real capital deployment

- Documentation templates for tracking analysis and results

- Common implementation challenges and their solutions

Rather than leaving students with just information, this section creates a bridge between learning and application—addressing the critical period where many educational resources fail to translate into practical results. The action plan breaks down the potentially overwhelming volume of course material into manageable implementation steps.

Emphasis is placed on deliberate practice rather than immediate full-scale trading, allowing skills to develop progressively without undue risk. Students receive a clear pathway to transform course knowledge into trading competence through structured application.

Avoiding Common Technical Analysis Pitfalls in Cryptocurrency Markets

This section addresses the most frequent mistakes traders make when applying technical analysis to crypto markets:

- Over-analysis paralysis and its prevention techniques

- Handling crypto-specific market anomalies not seen in traditional markets

- Appropriate timeframe selection for different trading objectives

- Balancing conflicting signals across different technical tools

- Emotional management during technical setup execution

- Adapting analysis during extreme volatility events

By anticipating these common challenges, the course prepares students for the realities of market analysis beyond idealized examples. This pragmatic approach creates realistic expectations while providing strategies to overcome typical obstacles.

The section emphasizes the iterative nature of skill development in technical analysis, normalizing the learning process while providing frameworks to accelerate improvement through structured reflection and adjustment.

Integrating Technical Analysis with Fundamental and On-Chain Metrics

This section explores how technical analysis functions as part of a complete analytical framework:

- Correlation between technical setups and fundamental developments

- Using on-chain data to confirm technical analysis signals

- Market sentiment analysis alongside technical patterns

- Building a holistic trading approach beyond pure technicals

- Case studies showing multi-faceted analysis in action

Rather than presenting technical analysis as the only valid approach, this section shows how it complements other analytical frameworks to create a more comprehensive market perspective. Students learn to contextualize technical signals within the broader cryptocurrency ecosystem.

This integrated approach reflects the reality of cryptocurrency markets, where on-chain metrics and fundamental developments often drive technical behaviors. By understanding these relationships, students develop a more sophisticated analytical framework beyond isolated technical analysis.

CONCLUSION

The Cryptocurrency Technical Analysis Course By Rekt Capital represents a comprehensive solution for anyone looking to master the technical aspects of cryptocurrency trading. With its structured curriculum covering both analysis techniques and risk management strategies, this course equips traders with the tools needed to navigate the complex and volatile cryptocurrency markets confidently.

By combining theoretical knowledge with practical application through webinars and worked examples, the course bridges the gap between understanding technical concepts and successfully implementing them in real-world trading scenarios. Whether you’re a beginner looking to build a solid foundation or an intermediate trader aiming to refine your strategy, this course offers the depth and breadth of content necessary to elevate your cryptocurrency trading skills to a professional level.

TERMS OF SALE

After you make payment, we will send the link to your email then you can download the course anytime, anywhere you want. Our file hosted on Pcloud, Mega.Nz and Google-Drive. If you don’t see the email in your inbox, please check your “junk mail” folder or “spam” folder!

We provide a download link including full courses as my description. Do NOT include any access into Groups or Websites!

LOADCOURSE – Best Discount Trading & Marketing Courses

🔥 More courses: Forex & Trading

Related products

Forex & Trading

Forex & Trading

Business & Sales

Forex & Trading

Forex & Trading

Forex & Trading

Forex & Trading

Forex & Trading