Jayson Casper – White Phoenix’s The Smart Money Approach to Trading

$ 700,00 Original price was: $ 700,00.$ 15,00Current price is: $ 15,00.

White Phoenix’s The Smart (Money) Approach to Trading By Jayson Casper: Master Institutional Trading Strategies

Course Overview: Decode Smart Money Trading Techniques

Unlock the secrets of institutional investors and enhance your trading skills with White Phoenix’s comprehensive course on smart money trading strategies. Developed by trading expert Jayson Casper, this in-depth program reveals how sophisticated market players operate and how you can align your trading approach with these institutional practices.

By understanding smart money behavior, you’ll gain the ability to:

- Anticipate major market moves and reversals before they happen

- Implement high-probability trading setups across any market

- Develop a sustainable trading edge using professional techniques

This comprehensive course covers essential trading principles including advanced risk management, detailed market structure analysis, supply and demand dynamics, and professional orderflow techniques. Whether you’re building a foundation or advancing existing skills, you’ll receive the ultimate toolkit to become a more efficient, confident trader.

Understanding the Smart Money Philosophy

What Is “Smart Money” in Today’s Markets

Smart money means the money controlled by big banks, hedge funds, and professional traders. These players move markets with their large orders. They have better tools, more data, and deeper research than regular traders.

Unlike everyday traders who react to price changes, smart money creates those changes. They follow a pattern of buying low (accumulation), riding the trend up (markup), selling high (distribution), and stepping aside during drops (markdown). Seeing these patterns helps you trade with the market’s natural flow.

How Big Investors Move Markets

Big investors shape markets in ways most people miss. They create key support and resistance levels through their buying and selling.

These pros often do the opposite of what most traders do. When everyone is excited about buying, institutions often sell. When everyone fears the market, institutions often buy. This explains why markets often turn around when sentiment reaches extremes.

Large players also create market swings through their order timing and position building. Understanding these moves helps you spot turning points before they show up in regular charts.

The White Phoenix Method: Basics and Origins

The White Phoenix Method gets its name from the phoenix bird that rises from ashes. Created by Jayson Casper, it teaches you how to spot and follow big money moves instead of fighting against them.

Key ideas include:

- Market Structure: Finding the pattern of highs and lows across timeframes

- Liquidity Zones: Spotting where big orders cluster

- Order Blocks: Finding where strong moves begin

- Trading Psychology: Understanding how different traders behave

This method changes how you see price charts. You’ll focus on actual big-money footprints rather than lagging indicators.

Why Retail Traders Fail Against Institutional Players

Retail traders consistently struggle against institutions for several fundamental reasons. First, most retail traders chase momentum after moves have already occurred, essentially buying into institutional distribution phases and selling into accumulation.

Second, retail traders often overtrade and employ improper position sizing, exposing themselves to excessive risk compared to institutions’ careful risk management. This leads to emotional decision-making during drawdowns, precisely when institutions capitalize on retail liquidations.

Third, retail participants typically rely on conventional technical indicators that institutions understand and exploit. Smart money operators frequently engineer price movements specifically designed to trigger retail stop-losses and create false breakouts.

By understanding these dynamics, traders can recognize retail traps and position themselves alongside institutional movements rather than becoming victims of professional manipulation.

The Technical Foundation of Smart Money Trading

Market Structure: Reading Charts Like the Pros

Market structure forms the foundation of big-money trading decisions. It means recognizing patterns of higher highs and higher lows in uptrends, and lower highs and lower lows in downtrends.

The Smart Money approach focuses on:

- Change of Character: Points where market behavior shifts

- Break of Structure: When price breaks previous structural levels

- Range to Trend Shifts: When markets change from sideways to directional

- Internal Structure: Smaller patterns within larger moves

Learning market structure helps you spot reversals before normal indicators show them. This gives you better entries and tighter risk control.

Supply and Demand: Where the Big Money Trades

Smart money traders focus on supply and demand imbalances rather than simple support and resistance. These imbalances happen when big orders can’t be filled at certain prices.

Key concepts include:

- Supply Zones: Areas where selling overwhelms buying

- Demand Zones: Areas where buying dominates selling

- Liquidity Pools: Clusters of stop orders that big players target

- Order Absorption: When large players absorb orders without price moving

These dynamics explain why markets often return to certain price levels. They also show why apparent breakouts often fail before real moves begin.

Wyckoff Method: Time-Tested Big Money Patterns

The Wyckoff Method was created in the early 1900s but still works in today’s markets. White Phoenix updates these ideas for modern trading.

Important Wyckoff patterns include:

- Accumulation: Signs of institutional buying before uptrends

- Distribution: Signs of institutional selling before downtrends

- Re-accumulation: Smaller buying patterns within larger trends

- Composite Man: Viewing the market as if controlled by one entity

These patterns help you spot market turning points based on actual big-money behavior rather than indicators that lag behind.

Order Flow: Following the Money

Order flow analysis tracks real buying and selling pressure in markets. White Phoenix teaches practical ways to read order flow through price action.

Key order flow concepts include:

- Volume vs. Price: Finding mismatches between volume and price movement

- Tape Reading: Interpreting transaction data

- Depth Analysis: Spotting big limit orders

- Absorption: Recognizing when large volume doesn’t move price

These techniques show you institutional activity in real-time. This helps you trade alongside smart money rather than against it.

What Is The Smart Money Approach?

White Phoenix’s The Smart (Money) Approach to Trading represents an advanced trading methodology aligned with institutional practices. This structured program delivers:

- Institutional Market Analysis: Learn to identify significant trading zones where smart money enters and exits positions.

- Advanced Order Flow Interpretation: Develop the ability to read market movements through the lens of institutional participants.

- Psychological Trading Edge: Master techniques to overcome emotional biases that typically undermine retail traders.

- Risk-Optimized Position Management: Implement professional-grade risk controls that protect capital while maximizing exposure to favorable market conditions.

- Supply-Demand Zone Identification: Recognize precise areas where institutional interest creates predictable price reactions.

- Wyckoff Methodology Application: Learn to identify accumulation and distribution phases using time-tested market structure analysis.

Key Benefits: Why Choose This Smart Money Trading Approach

Data-Driven Trading Decisions

The course emphasizes empirical analysis techniques that minimize risks and maximize potential returns. This evidence-based approach helps identify lucrative opportunities while avoiding unnecessary exposure.

Professional Risk Management

Master sophisticated risk protection strategies including:

- Setting adaptive stop-loss orders

- Calculating optimal position sizing

- Developing portfolio diversification techniques

- Understanding compounding effects on account growth

Psychological Trading Discipline

Develop emotional resilience essential for consistent trading success through:

- Mindfulness techniques for volatile market conditions

- Emotional regulation strategies for clear decision-making

- Overcoming common psychological trading pitfalls

Comprehensive Trading Framework

Learn to analyze markets from multiple perspectives:

- Advanced market structure identification and application

- Institutional liquidity concepts and execution strategies

- Supply and demand zone recognition and validation

- Wyckoff methodology for accumulation and distribution phases

Proprietary Trading Strategies

Access exclusive Phoenix trading techniques including:

- Deviation trading methods

- Range reversal models

- Supply to demand flip strategies

- Breakout block execution plans

Detailed Course Curriculum

The program is structured into logical, progressive modules covering:

- Risk Management Fundamentals

- Position sizing and compounding principles

- Leverage management

- Trade de-risking techniques

- Market Structure Analysis

- Break of structure identification

- Multiple timeframe structure integration

- Bias determination methods

- Target setting frameworks

- Supply and Demand Dynamics

- Zone classification and validation

- Fair value gap assessment

- Inducement theory application

- Liquidity sweep zone recognition

- Advanced Orderflow Concepts

- Initiation and continuation patterns

- Mitigation techniques

- Counter-trend trading approaches

- Professional entry methods

- Institutional Liquidity Management

- Buy-side/sell-side liquidity identification

- Liquidity curve trading

- Trendline interaction strategies

- Range Trading Mastery

- Premium vs. discount pricing models

- Deviation trading techniques

- Significant range identification

- High-probability range setups

- Wyckoff Methodology

- Accumulation and distribution schematics

- Phase analysis techniques

- Re-accumulation and re-distribution patterns

- Wyckoff model backtesting

- Proprietary Phoenix Trading Strategies

- Phoenix Deviation Technique

- Range Reversal Models

- Supply/Demand Flip Theory

- Integrated strategy implementation

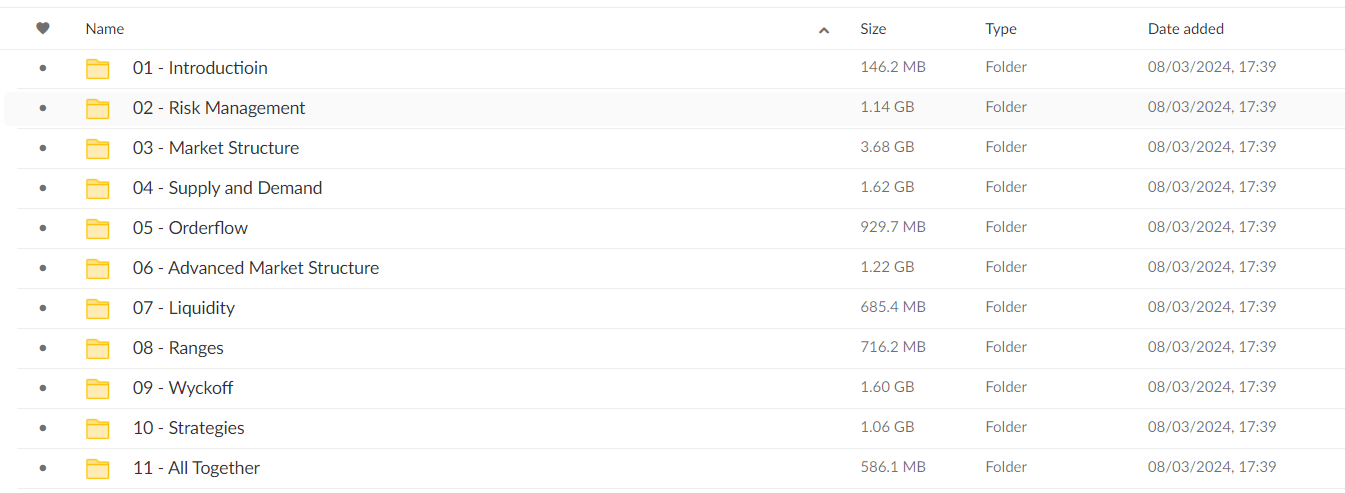

PROOF OF COURSE (13.3 GB):

What You Will Learn From White Phoenix’s The Smart Money Course:

This course promises a learning journey, offering:

- Practical skills in risk management and market structure analysis.

- Insights into institutional trading concepts and liquidity management.

- Strategies to identify high-potential trading zones using supply and demand principles.

- Techniques for trading Wyckoff schematics and other exclusive strategies.

Who Should Enroll: From Beginners to Advanced Traders

This comprehensive trading program is ideal for:

- Beginner traders seeking a solid foundation in professional trading practices

- Experienced traders looking to refine their approach with institutional methods

- Technical analysts wanting deeper insight into market structure and order flow

- Long-term investors interested in understanding smart money market movements

- Crypto traders seeking transferable skills for volatile digital asset markets

Who is Jayson Casper?

White Phoenix’s The Smart Money Approach to Trading course is developed and taught by Jayson Casper, a trading expert specializing in institutional trading methodologies. His smart money approach has helped traders align their strategies with market-moving entities to achieve more consistent results across various market conditions.

Case Studies: Smart Money in Real Markets

Real Examples of Institutional Manipulation

Abstract concepts become actionable through detailed examples. White Phoenix includes extensive analysis of actual market manipulations.

Institutional manipulation examples include:

- Major Market Reversals: Breaking down turning points in various markets

- Liquidity Hunt Examples: Examining specific stop-hunting sequences

- Accumulation Studies: Identifying institutional buying before big rallies

- Distribution Examples: Recognizing selling before major declines

These real-world applications show how theoretical concepts work in actual trading.

Analyzing Big Market Moves Through Smart Money Eyes

Historical market moves provide valuable lessons when viewed through institutional perspectives. White Phoenix reexamines famous market events through this special lens.

Historical analysis includes:

- Market Crash Studies: Identifying institutional positioning before big drops

- Bull Market Beginnings: Recognizing accumulation before major uptrends

- Sector Rotation Patterns: Understanding how institutions move money between sectors

- Volatility Event Navigation: Examining best responses to sudden market changes

These historical perspectives provide context for current market conditions and prepare you for future scenarios.

Trading Journal Examples

Practical application requires knowing how to document and analyze your trading. White Phoenix includes comprehensive journaling practices.

Effective journaling includes:

- Setup Documentation: Recording essential trade details

- Performance Tracking: Measuring key success indicators

- Psychological Notes: Connecting mental states with outcomes

- Pattern Recognition: Identifying recurring strengths and weaknesses

These journaling practices transform trading from random events into a structured path for continuous improvement.

Success Stories and Lessons

Real trader experiences provide motivation and practical insights. White Phoenix includes case studies of people who successfully used these approaches.

Inspirational elements include:

- Transformation Stories: Traders who overcame significant challenges

- Technique Applications: Specific examples of successful strategy use

- Adaptation Cases: How traders modified approaches for their situations

- Common Mistakes: Learning from others’ errors to avoid repeating them

These stories connect abstract concepts to real outcomes, showing the practical value of the Smart Money approach.

FAQs: Gaining the Smart Money Edge

Is prior trading experience required to take this course?

No, this course is structured to benefit both novices and experienced traders alike, with comprehensive modules tailored to all levels.

Can the strategies taught be applied across different markets?

Absolutely. The principles and strategies covered are versatile and can be applied to stocks, forex, commodities, and more.

What makes this course unique?

“The Smart Money Approach to Trading” demystifies the operational strategies of the financial market’s most influential players. It provides actionable knowledge and tools, enabling traders to move with the market’s smart money, not against it.

CONCLUSION: Transform Your Trading with Institutional Insights

White Phoenix’s The Smart (Money) Approach to Trading provides a rare opportunity to learn institutional trading practices that can significantly enhance your market analysis and execution. By mastering these professional trading techniques, you’ll develop a more structured, disciplined approach that can lead to improved consistency and reduced emotional decision-making.

What differentiates this program is its comprehensive integration of market structure, liquidity analysis, psychological discipline, and proprietary strategies into a cohesive trading framework that works across multiple markets and timeframes. This holistic approach ensures you develop not just isolated techniques but a complete smart money trading system.

Take your trading to the next level by learning to think and trade like the institutions that move markets.

If you’re interested in learning, check out the offer below. It might be exactly what you need!

👉 Jayson Casper – Advance Trading Course 2023 (Download) — $30

TERMS OF SALE

After you make payment, we will send the link to your email then you can download the course anytime, anywhere you want. Our file hosted on Pcloud, Mega.Nz and Google-Drive. If you don’t see the email in your inbox, please check your “junk mail” folder or “spam” folder!

We provide a download link including full courses as my description. Do NOT include any access into Groups or Websites!

LOADCOURSE – Best Discount Trading & Marketing Courses

🔥 More courses: Forex & Trading

Related products

Forex & Trading

Internet Marketing

Forex & Trading

Business & Sales

Forex & Trading

Business & Sales

Business & Sales

Business & Sales